are 529 contributions tax deductible in south carolina

South Carolina Deduct any amount. Web South Carolina.

10 Reasons To Consider A Future Scholar 529 Plan At Tax Time Sponsored Content Post And Courier Charleston Sc

South Dakota has no individual income.

. Web Future Scholar account contributions may be tax-deductible up to the maximum account balance limit of 54000 0 per beneficiary or any lower limit under applicable law. Web While more than 30 states including the District of Columbia offer some sort of state income tax deduction for qualifying 529 plan contributions South Carolina is just. Web Yes - that is deductible.

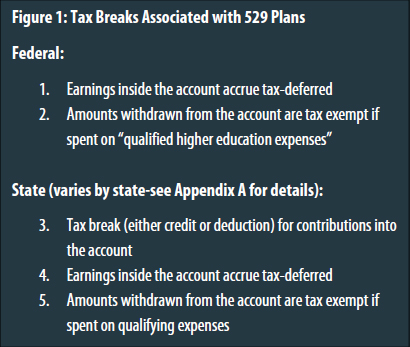

Never are 529 contributions tax deductible on the federal level. Rhode Island Deduct up to 500 per year. Web As previously mentioned 529 contributions are not deductible on federal tax returns.

SUBTRACTIONS FROM FEDERAL TAXABLE INCOME. In fact South Carolina is one of six states where you can still make a contribution to the state administered 529 plan Future Scholar and claim a deduction for the prior tax. Web Its even possible to make five years worth of contributions in a single year up to 75000 or 150000 for married couples and still get the gift tax exclusion.

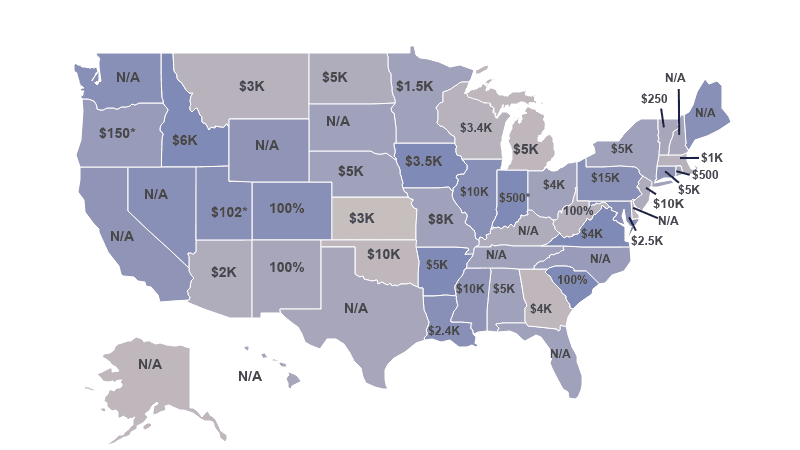

Web In Colorado New Mexico South Carolina and West Virginia 529 plan contributions are fully deductible in computing state income tax. In South Carolina families can deduct 100 of their 529 contributions. Web Oregon Can claim up to 150 as a tax credit for contributions.

Virginia Up to 4000 per year per account can be deducted. Web Although contributions arent tax-deductible the earnings in a 529 account arent subject to tax treatment by the state or federal government when theyre used to. Your new state may offer a state tax benefit per taxpayer or per beneficiary.

Web Most states limit the amount of annual 529 plan contributions eligible for a state income tax benefit but annual 529 plan contributions are fully deductible in. Web For south carolina residents contributions to the sc future scholar program can be deducted on their state income tax return. Or residents who meet certain income requirements may claim a tax credit.

Web Contributions to any states 529 plan up to 1500 3000 if married are deductible. Web The amount of 529 plan Apr 21 2022 - Are 529 Contributions Tax Deductible In South Carolina. Check with your 529 plan or your.

Web Earnings from 529 plans are not subject to federal tax and generally not subject to state tax when used for qualified education expenses such as tuition fees books as. However most states sponsor at least one 529 College Savings Plan and. However some states may consider 529 contributions tax deductible.

Taxpayers age 70 or older can deduct any. In south carolina contributions to a single. Web South Carolina All contributions to an in-state 529 plan are deductible.

Web The top South Carolina income tax rate is 7 meaning that for each 1000 contributed to the state-sponsored 529 plan can save a taxpayer up to 70 when filing.

Are Contributions To A 529 Plan Tax Deductible Sootchy

How Do I Write Off 529 Plan Contributions On My Taxes Sootchy

So Much To Love About 529 Plans Sc Office Of The State Treasurer

Save Money With South Carolina 529 Tax Deduction Future Scholar

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance

6 Facts Every Parent Should Know About 529 Plan Tax Deductions Student Loan Hero

What Are The 529 Plan Contribution Limits For 2022 Smartasset

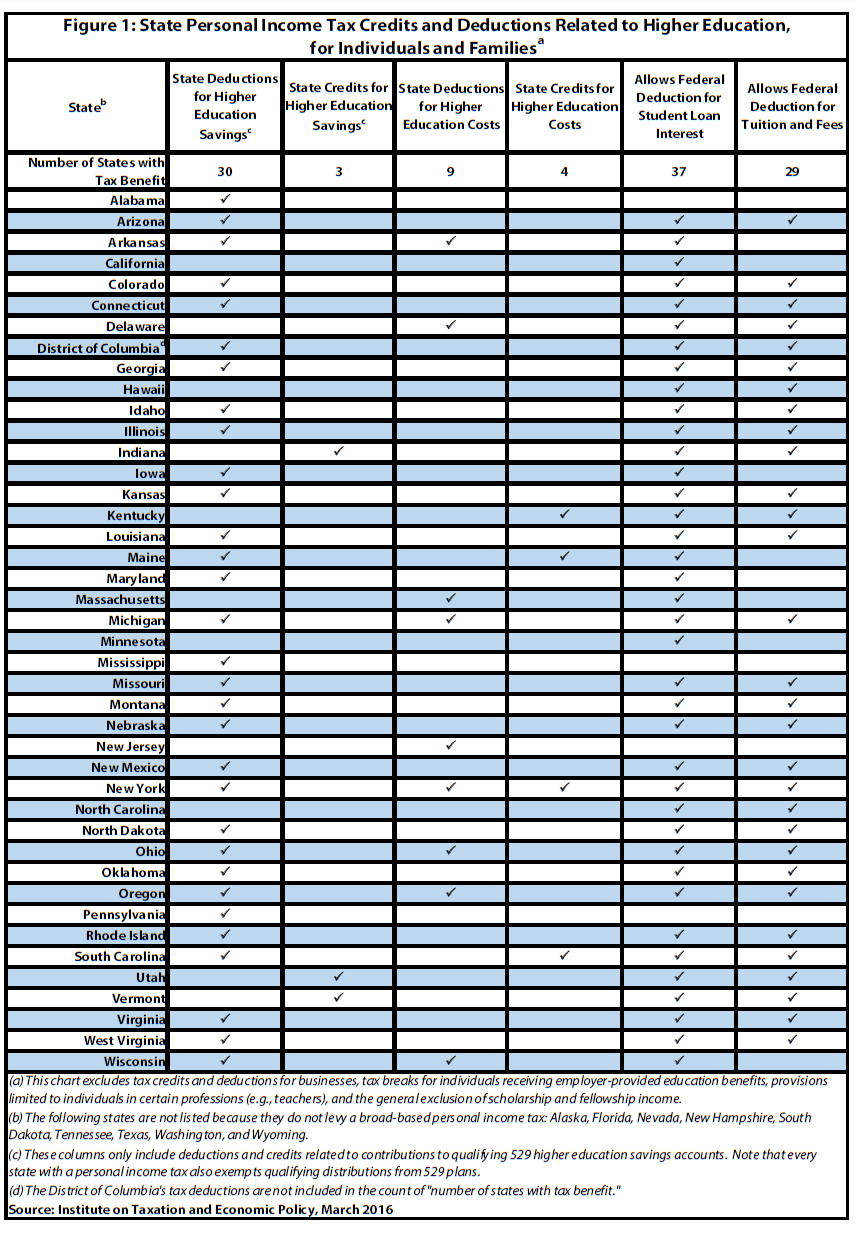

Higher Education Income Tax Deductions And Credits In The States Itep

Kansas 529 Plans Learn The Basics Get 30 Free For College Savings

South Carolina 529 Plan And College Savings Options Future Scholar

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

529 College Savings Plan Options Broken Down By State

College Foundation Of North Carolina

Save Money With South Carolina 529 Tax Deduction Future Scholar

Choosing And Funding Your 529 Plan South Carolina Financial Planners

How Much Are 529 Plans Tax Benefits Worth Morningstar

What Is A 529 Plan And Should I Get One Student Loan Hero

Preventing State Tax Subsidies For Private K 12 Education In The Wake Of The New Federal 529 Law Itep

10 Reasons To Consider This College Savings 529 Plan At Tax Time